|

Buffett hits a bumpy road

|

|

January 20, 2000: 6:17 a.m. ET

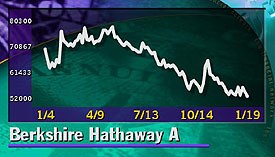

With Berkshire stock near 52-week low, questions raised about investor's touch

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Little that Warren Buffett has been touching has turned to gold of late.

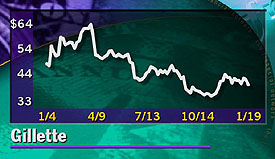

Shares of his company, Berkshire Hathaway Inc., are near their 52-week low. Berkshire is struggling to digest its biggest-ever acquisition, a deal some investors think was a mistake. And Buffett, who likes to make big plays in a handful of companies, saw many of his stock picks -- Coca-Cola, Gillette, Freddie Mac -- crumble in last year's roaring market.

The world's second-richest man was worth $36 billion at Forbes' last count. That could cause a little envy. It's tempting to wonder: has the world's most famous investor lost his Midas touch?

The technophobe sees his stock tumble

Buffett, 69, bought his first stock at age 11 and took control of Berkshire Hathaway, a down-on-its-luck New England textile maker, in 1965. So it may be unfair to write off a highly successful half-century of investing and a quarter-century of stellar returns for Berkshire's stock, which has increased just under 3,000 percent, after 12 middling months.

Berkshire has been beaten down from close to an all-time high in the spring of 1999

But Buffett admits he made mistakes in managing Berkshire's portfolio in 1998, most notably in selling McDonald (MCD)'s stock. More noticeably, he claims to know nothing about technology and steers clear of that sector. Berkshire's Web site portrays the pointedly down-to-earth billionaire as a "technophobe" who can't figure out e-mail.

Buffett, who declined to be interviewed for this story, has said he can't "see" what technology businesses will look like in 10 years or who the market leaders will be. So he has shied away.

By doing so, he has completely missed a roaring tech market that pushed the Nasdaq composite up 86 percent in 1999. That's more than any major index has ever risen in a year. Instead, Buffett concentrates his investments in a handful of companies that are relatively easy to understand, and in Buffett's eye, to predict.

But some Buffett picks didn't perform in 1999

They have a strong consumer bent. At the end of 1998, the company's most recent figures, Berkshire Hathaway's largest holdings were Coke (KO), American Express (AXP), Gillette (G), mortgage bundler Freddie Mac (FRE), Wells Fargo (WFC), Disney (DIS) and Washington Post (WPO).

Some of those are highly international, meaning they grow at the rate of world expansion. The U.S. has performed stronger of late. Some observers say the prospects of companies like Coke and Gillette are muted, as they reach maturity in emerging markets that fueled growth at the start of the '90s.

There is nothing wrong with Buffett's investment philosophy, said Robert Hagstrom, who manages the Legg Mason Focus Trust and has written two books on Buffett, including The Warren Buffett Way. The approach involves picking a focused portfolio, analyzing companies as businesses rather than just stocks, looking for good profits and big, recognizable brand names, and holding the stocks a very, very long time, ignoring short-term market movements.

"It seems to me that approach is timeless," Hagstrom said. A company such as Coke struggled through significant problems last year, ultimately leading to CEO Douglas Ivester stepping down -- reportedly with a nudge from Buffett. But Coke and Buffett's other big plays are hardly likely to prove poor long-term investments. Other picks such as American Express performed very well last year.

Multinationals like Gillette and Coke did not match the runaway returns they've produced in the past.

Hagstrom does think Buffett is wrong to stay out of technology, which Buffett has avoided because it doesn't have the big margin of safety that brand-name multinationals do.

But some investors apply Buffett-like techniques to technology stocks, Hagstrom said, meeting with considerable success. Tom Marsico, former Janus 20 manager, picks a concentrated portfolio that blends technology with value stocks that would warm the heart of Buffett's teacher, Ben Graham.

Buffett has changed the face of Berkshire

Is Buffett too old-fashioned to prosper in high-tech times? You certainly won't see him buying Qualcomm (QCOM) or Akamai Technologies (AKAM) any time soon. While the tech boom lasts, he will likely underperform. But in the back of investors' minds, the thought may linger that the tortoise still ended up beating the hare. He was certainly more relaxed.

Focusing on Buffett's investments misses the point, however. In the late '90s, he transformed Omaha, Neb.-based Berkshire Hathaway from what many regarded as a stock holding company or unit trust into a genuine operating company.

With stock prices high, Berkshire has snapped up whole companies that are keen to benefit from the capital and hands-off management Berkshire provides. Some also want to escape the scrutiny that comes with being a public company. Buffet and Berkshire continue to look for more acquisitions.

Long history of owning companies

By far Berkshire Hathaway's greatest focus is insurance, one of Buffett's favorite industries and notoriously stodgy. Berkshire closed its biggest deal, the $22 billion buyout of reinsurer General Re, in late December 1998. In 1996 it paid $2.3 billion for the half of Geico it didn't own. The automobile insurer has been on a major marketing blitz.

Buffett has said he prefers the greater control and accounting benefits of owning a company outright to buying a chunk of stock. The challenge is landing companies at the right price. Berkshire also has a tradition of owning insurance companies. In 1967, shortly after Buffett took control, it bought reinsurer National Indemnity.

Berkshire's insurance companies now largely own the equity investments. That makes it hard to separate the two, and it's also hard to compare an investment to an operating company. But PaineWebber analyst Alice Schroeder figures Berkshire's equity holdings account for a quarter of its market capitalization. Its insurance businesses make up around 70 percent of its revenue.

Insurance woes dragging performance

The insurance industry had a horrible year last year. Schroeder points out that Buffett in fact outperformed that sector. But she said General Re has suffered "indigestion" since Berkshire bought it. It has given up almost $1 billion in underwriting losses and become "topic one on investors' minds."

It's not clear why General Re's results have been worse than its peers, Schroeder said. But Buffett and his vice chairman, Charles Munger, have said that in general they prefer taking a bumpier 15 percent return over a steady 12 percent return. That more-aggressive approach to General Re's underwriting, coupled with strict accounting that took certain charges ahead of General Re's peers, may provide partial answers.

Buffett supporters point to a number of other reasons why the General Re acquisition has hurt Berkshire's stock price. Berkshire is a favorite of individual investors, who own 81 percent of the stock. That ratio was roughly reversed at General Re, where institutions liked its steady returns.

Many sold after the buyout, either because they didn't share Buffett's fondness for a bumpier ride or because Berkshire is startlingly uncommunicative with Wall Street. General Re was also in the S&P 500 index and Berkshire is not, so S&P 500 index fund managers had to sell the stock.

"There have been plenty of sellers this past year," said George Brumley, chairman and CEO of Oak Value Capital Management in Durham, N.C. "It's very simple. There has been more supply than there has been demand."

Brumley, whose uncle was a classmate of Buffett's at Columbia University, has made Berkshire the largest holding of his Oak Value Fund. It accounts for a tenth of the fund's $400 million in assets. Brumley also models his investing approach after Buffett's.

Some think Berkshire is ripe for buying

He looks at insurer American International Group (AIG), which is trading near its 52-week high, and comes to the conclusion that there is "a major disconnect with reality" when it comes to Berkshire's stock. That is 36 percent off its all-time high of $80,900 in June 1998. "I firmly believe this is a period of very significant undervaluation for Berkshire stock," Brumley said.

Schroeder agrees and thinks the stock, which has the well-known highly priced class A shares and a B class that's just under a thirtieth of the price, is trading at a discount of roughly 25 percent to its intrinsic value.

But she doesn't know how long General Re will take to turn around. Without another acquisition, the fate of that company will drive Berkshire. "This is not a stock for someone who measures things on a quarter-for-quarter basis," she said.

Buffett may become famous for more than investing. His management skills are highly underrated, Schroeder said, after seeing him in action. Though some investors fault him for failing to announce his successor, others are confident when he says he has two lined up, one for the investments, one for the operating businesses.

His management skills may help him shape Berkshire into a success of a different sort, built around the companies it has bought and is looking to buy. Executives sometimes sell to him at a discount, to benefit from his leadership. He lets them make their own operating decisions.

"He's exceptionally qualified as a manager," Schroeder said. There's something inevitable about it that bodes well for Berkshire's future. "His charm and force of personality cause people to do what he wants. It just happens."

|

|

|

|

|

|

|