Last year, when the price of bitcoin rose 1,000%, you might have regretted not buying in. Now that it has fallen almost 40% so this year, perhaps you don’t have as many regrets. The murky trading and wrenching volatility of cryptocurrencies threaten their place as a fundamental plank of the future financial system, as proponents are pushing. Now, a group of famed economists and financial innovators have a plan to address those challenges by creating “the first non-anonymous blockchain-based digital currency,” called Saga (SGA).

Think of it as a cryptocurrency without all the things that make regulators, central bankers, and, frankly, most people nervous—the extreme volatility, the ambiguous notion of value, the anonymity.

Saga is being developed by The Saga Foundation, a Swiss non-profit created last year that is dedicated to developing new technologies in open and decentralized software. The advisory board includes Jacob Frenkel, the former Governor of the Bank of Israel and chairman of JPMorgan Chase International; economics Nobel laureate Myron Scholes, known for creating the Black-Scholes formula, the most well-known model for pricing options and derivatives; Dan Galai, a co-developer of VIX, the leading measure of financial market volatility; and Leo Melamed, the chairman emeritus of CME Group and pioneer in financial futures. Needless to say, the board knows a thing or two about how markets work.

The Saga token’s purported stability is intended to make it useful as a unit of account and a means of exchange, rather than a tool of pure speculation. The wild price swings in many—most, really—cryptocurrencies make them unappealing as a means of payment, to say nothing of the strains the volatility has put on the exchanges where they trade.

To ensure low volatility, Saga will employ methods from traditional finance. Saga will use a fractional reserve method (similar to what banks use) and deposit reserves in regulated banks. Saga will be essentially pegged to the IMF’s Special Drawing Right (SDR), an international reserve asset that’s comprised of a basket dominated by the US dollar and euro. Central banks also often keep the SDR in their official reserves.

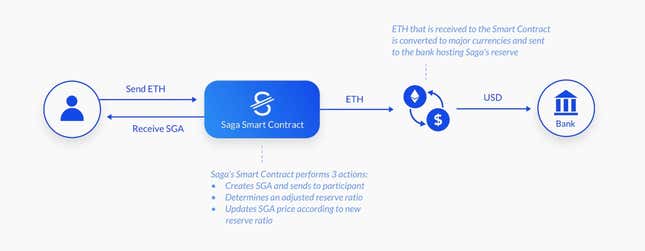

Saga’s money supply will be adjusted algorithmically according to the size of its economy: for example, when the economy expands, a smart contract increases the token supply, which will limit price rises. There will also be a price band to act as another check on volatility.

Holders of Saga must complete “know your customer” and anti-money laundering requirements under Swiss law. This removes the anonymity aspect, considered a crucial element of cryptocurrencies based on the idea of a decentralized system that exists outside the control of governments and central banks. It’s worth noting that such identification measures are already widely used by existing crypto exchanges, and in many token sales.

There is also some irony in a cryptocurrency backed by fractional reserves. This was anathema to the founding principles of bitcoin, the granddaddy of cryptocurrencies. Its creator, Satoshi Nakamoto, encoded a message in the first bitcoin block ever mined, which says: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” That was not exactly a ringing endorsement of the traditional financial processes being touted by Saga’s distinguished crew.

But a coin whose price doesn’t swing wildly—a so-called “stablecoin”—is something that has been pursued by the cryptorati for some time. The most high-profile example is Tether, a token whose makers claim is fully backed by dollar reserves, with each tether backed by one US dollar. There is about $2.3 billion worth of Tether circulating on global crypto-markets today, but no one is sure whether those cash reserves truly exist. Tether’s creators have fired an auditor it hired to verify its claims, raising further suspicions from the market.

Saga joins a rush to create a legitimate stablecoin, including some backed by big-name Silicon Valley investors. They include Basecoin, which promises a price regulated by an “algorithmic central bank” and Dai token, whose value against the US dollar is set by a “decentralized autonomous organization”—a sort of mashup between algorithms and continuous shareholder voting. Both are backed by the blue-chip venture capital firm Andreessen Horowitz.

Saga tokens can be bought starting in the fourth quarter of this year, the foundation’s website says, and can be purchased using ether or a bank transfer to one the banks holding Saga’s reserves. Here’s how it works with ether:

Rather than doing an ICO, the usual method for issuing new coins in the crypto space, Saga has raised $30 million from investors at venture capital and hedge funds, including Mangrove Capital Partners and Lightspeed Venture Partners. Saga Genesis is being offered as a voucher token to early supporters and investors.

More broadly, the Saga Foundation wants to use blockchain to “re-examine governance paradigms” and come up with a new approach to how society exchanges value. If this sounds confusing, maybe this artsy video the foundation created can clear it up:

Or maybe not.