- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

New survey reveals American retirees currently have a negative outlook on Bitcoin

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th October 2019, 03:09 pm

Retirees are not well-known for being major risk takers. In fact, quite the opposite is true with their age bracket. This is why it should not come as a huge surprise that they look at Bitcoin and the other major cryptocurrencies with a skeptical eye.

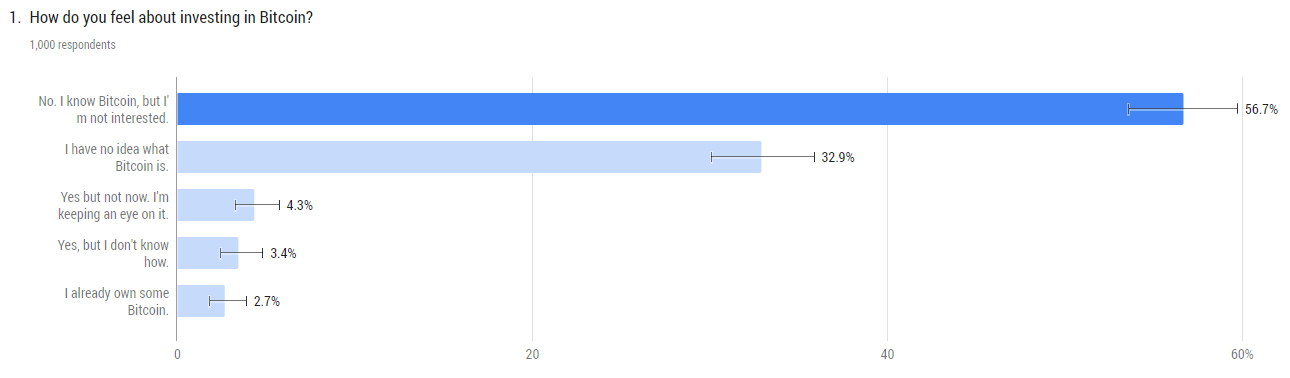

We conducted a study this month asking 1,000 respondents what their thoughts were about investing in Bitcoin. We used Google Surveys and targeted US retirees aged 50+ from coast to coast. The graph below reveals the results.

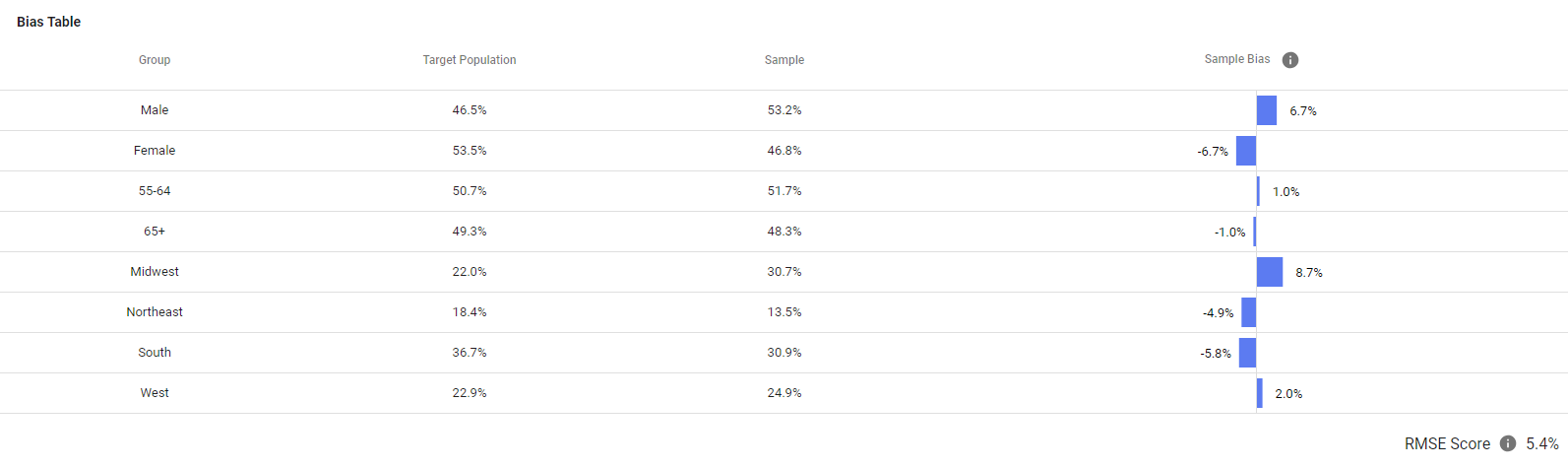

Audience: Users on websites in the Google Surveys Publisher Network, Method: Representative, Age: 55-64 and 65+

The Bitcoin community has some work to do to educate retirees

While 56.7% of respondents have chosen “No. I know Bitcoin, but I'm not interested”, 32.9% chose “I have no idea what Bitcoin is” which is quite surprising in 2019 but it's quite a telling number. This audience represents some low hanging fruit for the Bitcoin community to go after. Retirees are always interested in alternative assets that can help diversify their portfolio against market fluctuations. The IRS approving cryptocurrency IRAs is an indication that retirees are increasingly interested in including some cryptocurrencies in their retirement accounts.

The attitude of retirees also stands in marked contrast to the positions of younger investors. There could be several reasons for this. The graph provides a lot of insight into the investing mind of the retiree and what the proponents of Bitcoin might be able to do to turn around this demographic's opinion on the king of digital assets.

Bitcoin and the altcoins do represent a completely new class of assets for the markets as a whole. It is true that there have been massive price swings and enormous volatility that has made Bitcoin notorious in recent months and last year. Yet the volatility and potential to massively appreciate is highly attractive to those individuals who are willing to shoulder investment risks, as with especially younger investors.

The IRS has recently placed a stamp of legitimacy on the cryptocurrencies by approving several of the new Cryptocurrency IRAs. Ultimately, retirees will have to decide like the younger investors if this new highly volatile investment should have its place in their retirement account. Keeping all of this in mind, let's examine each aspect of the retiree survey on Bitcoin more closely here and what it means for retiree adoption of the digital assets.

Many Retired Investors Are Aware of Bitcoin but Still Are Not Interested

When asked how they feel about investing in Bitcoin, an astonishing 56.7 percent of those aged 55 to 65 and up said that they are aware of Bitcoin, yet they do not have any interest in owning it. This is more than one in two respondents. According to this most popular survey response, Bitcoin needs to do a better job of explaining the many benefits its underlying blockchain technology offers any number of businesses and industries. It also needs to do more to dispel the myth that it is a completely imaginary construct, something that tends to scare away older investors who remember bubbles even going back to the Great Depression all too well.

Second Largest Group of Retirees Do Not Know What Bitcoin Is

Looking at the second largest response from retirees to Bitcoin, it is more discouraging still:

The second greatest group of respondents stated that they have no idea at all what Bitcoin is. At almost 33 percent, this was nearly one in three survey takers who came back with this excuse. You can not expect them to leap at the opportunity to plow their hard-earned investment and retirement savings dollars into an asset class that they have no idea about. In response to this argument, Bitcoin needs to do much more to educate the retirees about it as a currency, technology, and investment. Only like this will more of them seriously consider diversifying some of their asset allocation to Bitcoin and potentially other digital assets.

Another Group of Retirees Does Not Know How to Invest in Bitcoin

A smaller but still important group has the excuse that they are at a total loss where investing in Bitcoin is concerned:

Fully three and a half percent said that they would like to invest but do not have any idea on where to start. This is yet again another example of poor investor education on the part of Bitcoin with this investing age bracket. The exchanges and other Bitcoin-related investments could help to explain safe, IRS-approved means of investing in the key digital assets. This way those retirees who are interested in Bitcoin could seriously consider investing in it.

The Smallest Retiree Group Owns At Least Some Bitcoin

The final and smallest group of respondents, a mere 2.7 percent, claim that they own at least some Bitcoin:

This shows that not all retirees are averse to Bitcoin. Still, it is a sad commentary that not even one in thirty survey respondents in the retired age bracket say that they own only some Bitcoin. Clearly the proponents and investment gurus behind Bitcoin have some significant work to do with the retiree category.

They might do this by making the following three arguments for Bitcoin:

- It is a government hedge – The stock and bond markets are often at the mercy of government's fiscal and monetary policies. Even the national currency the dollar is tightly controlled by the central bank the Federal Reserve. Government agencies and most of their actions cause fiat currencies to devalue over time. This means that they lose value compared to goods, services, and the financial markets. This is not the case for cryptocurrencies though. Their worth has little to do with the constantly shifting fiat environment. This is why an many analyst observers and investors view the digital currencies as contrarian assets like gold.

- It offers another form of retirement asset diversification – Done properly, real diversification involves investing in numerous asset classes, such as precious metals, real estate, and yes, potentially cryptocurrencies. As the digital assets keep increasing their adoption and rising higher in value over time, this will represent a once in a lifetime opportunity for investors wishing to substantially increase the value of their retirement savings.

- It provides massive longer term growth potential – Remember that the digital assets are a potentially terrific longer-term holding. It means that years or decades from now, they could be fantastic to have in your portfolio. This is why Bitcoin is ideally suited for retirement planning, as this future planning is built entirely on the longer term.

In Conclusion: Retirees and Younger Investors Alike Should Seriously Consider Long Term Investing in Cryptocurrencies

It is fair to say that the cryptocurrencies like Bitcoin deserve your careful study and contemplation as an asset class for your retirement portfolio. You should of course perform your own careful due diligence before determining if they work for your future retirement plans and goals. Bitcoin (and its younger digital asset siblings) remains extremely volatile and a highly risky asset class that may not ideally fit your current risk tolerance profile.

Details about the study and RMS score

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the number, the smaller the overall sample bias.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum