The Week On-Chain (Week 40, 2020)

Despite a number of potentially unsettling events over the past week, BTC has remained largely stable at over $10,000, and its on-chain fundamentals are still strong.

Bitcoin Market Health

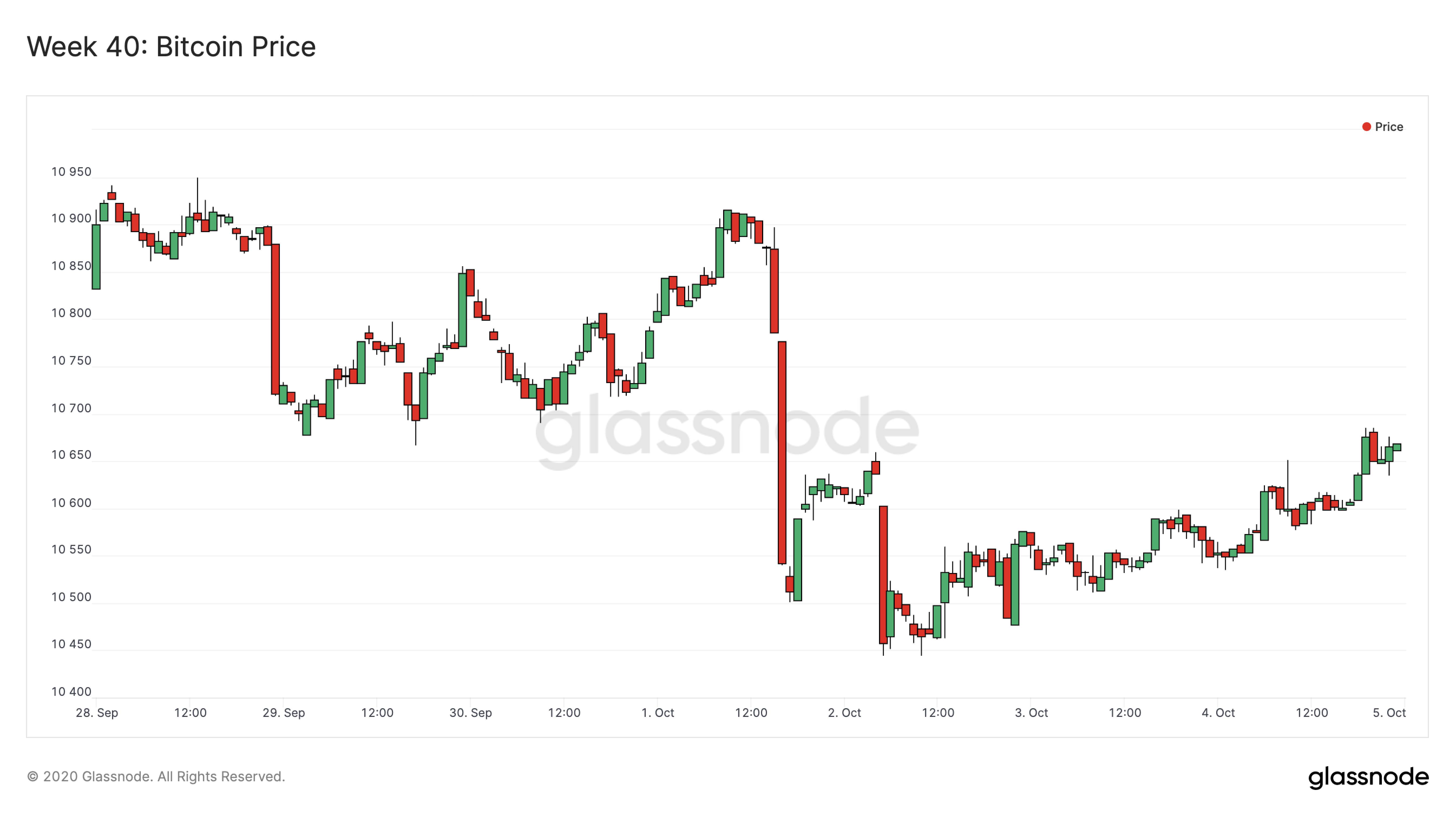

BTC lost a small percentage of its value over Week 40, starting the week at a price of around $10,730 and ending it at $10,650. The price dropped sharply on Thursday, reaching a low of $10,450, but it gradually recovered throughout the remainder of the week.

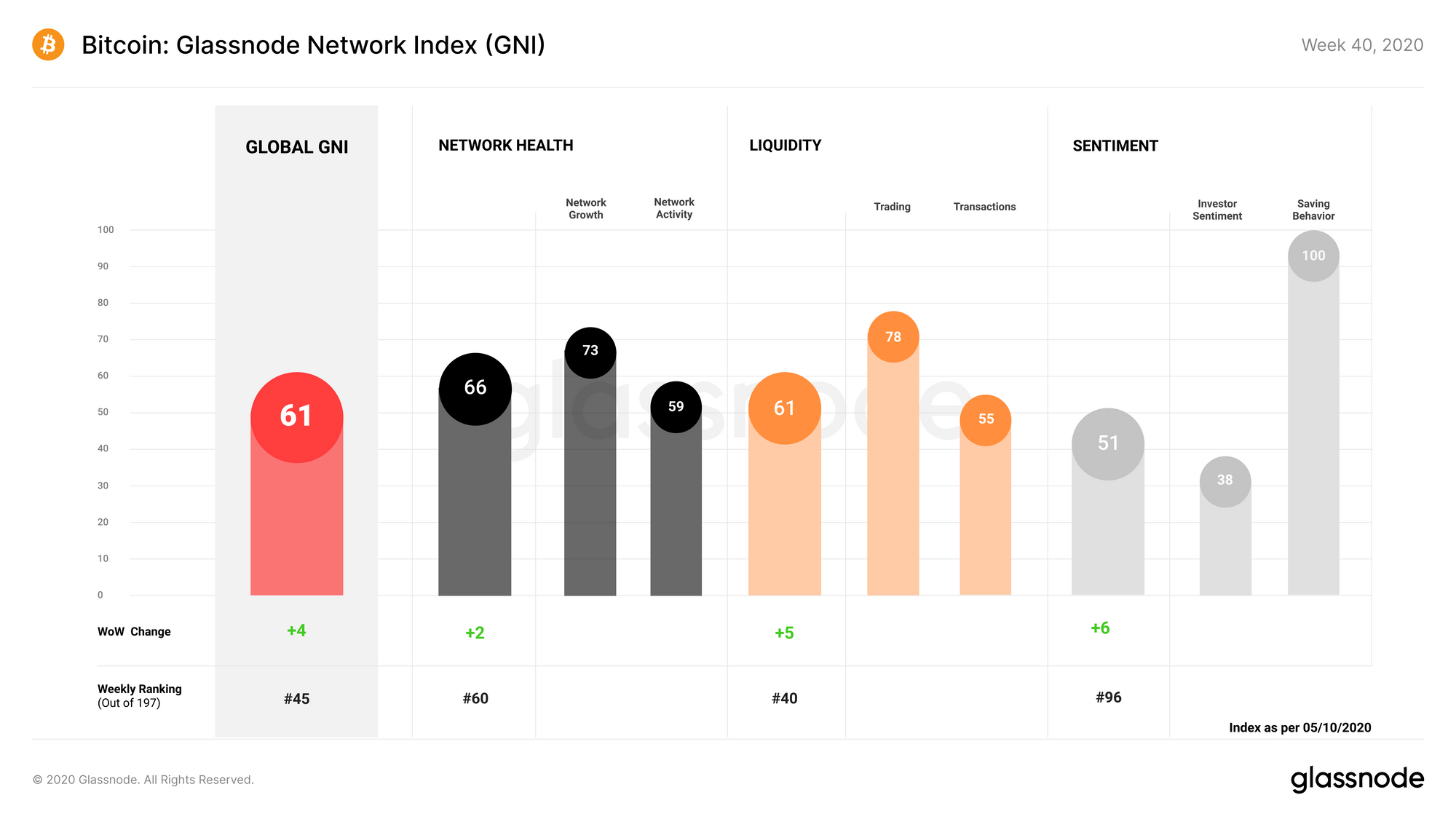

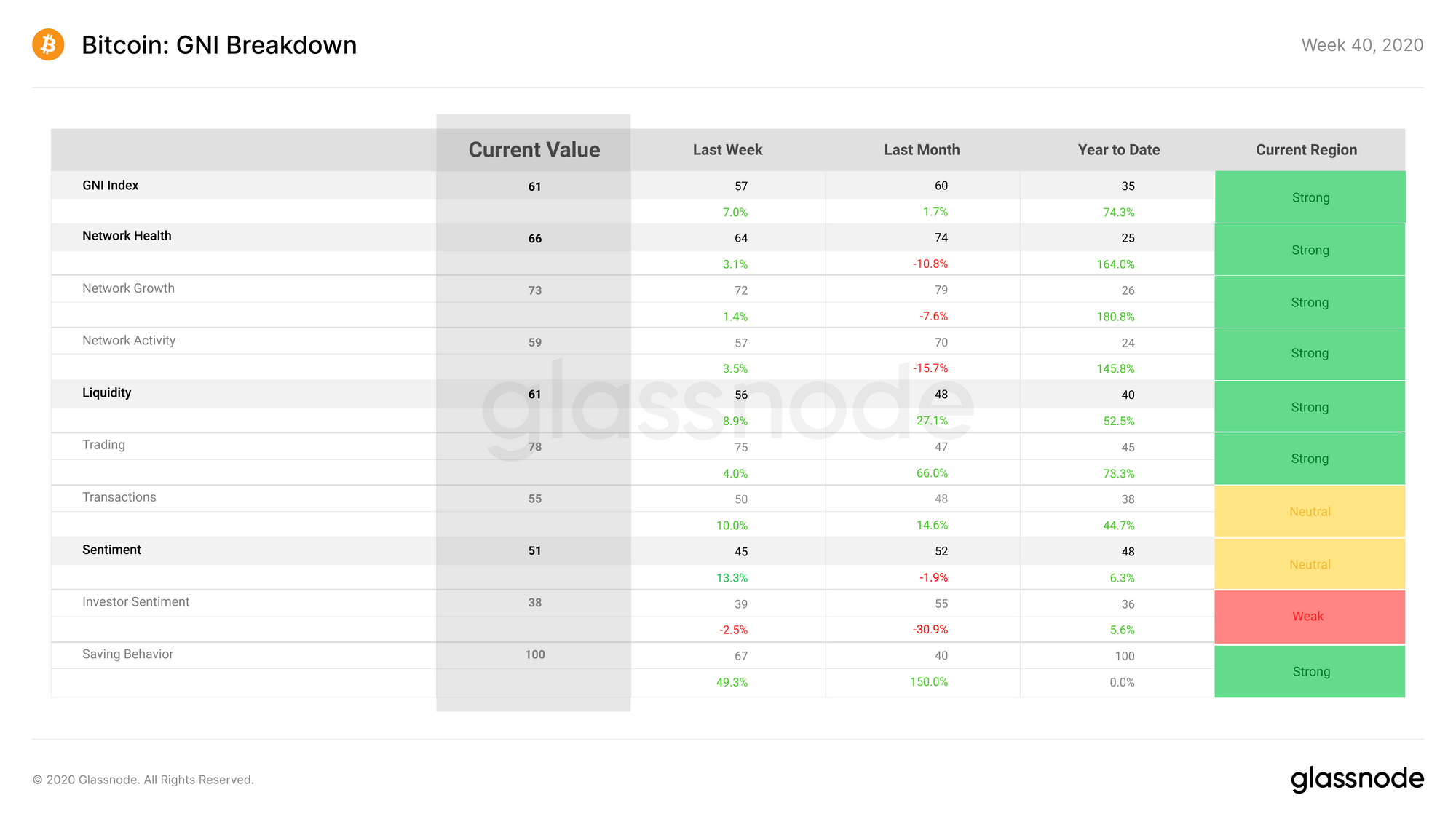

Bitcoin on-chain fundamentals recovered slightly during Week 40 after dipping the previous week. GNI gained 4 points, taking it to a score of 61, with all three subindices seeing positive growth throughout the week.

Network Health gained 2 points over the week, bringing it to a strong score of 66 points. The network growth subcategory saw modest gains as a result of a rise in the number of new entities joining the Bitcoin network. The network activity score also rose as the number of active entities grew.

Liquidity reached a score of 61 points, gaining 5 points from the previous week. This was mostly due to an increase in transaction liquidity, driven by slightly higher on-chain trading volumes and a small rise in velocity.

Sentiment performed the best of all three subindices for Week 40, gaining 6 points to bring it to a score of 41. The saving behavior subcategory performed particularly well, shooting up to a score of 100 as hodlers started acquiring BTC at a faster rate.

Glassnode Compass

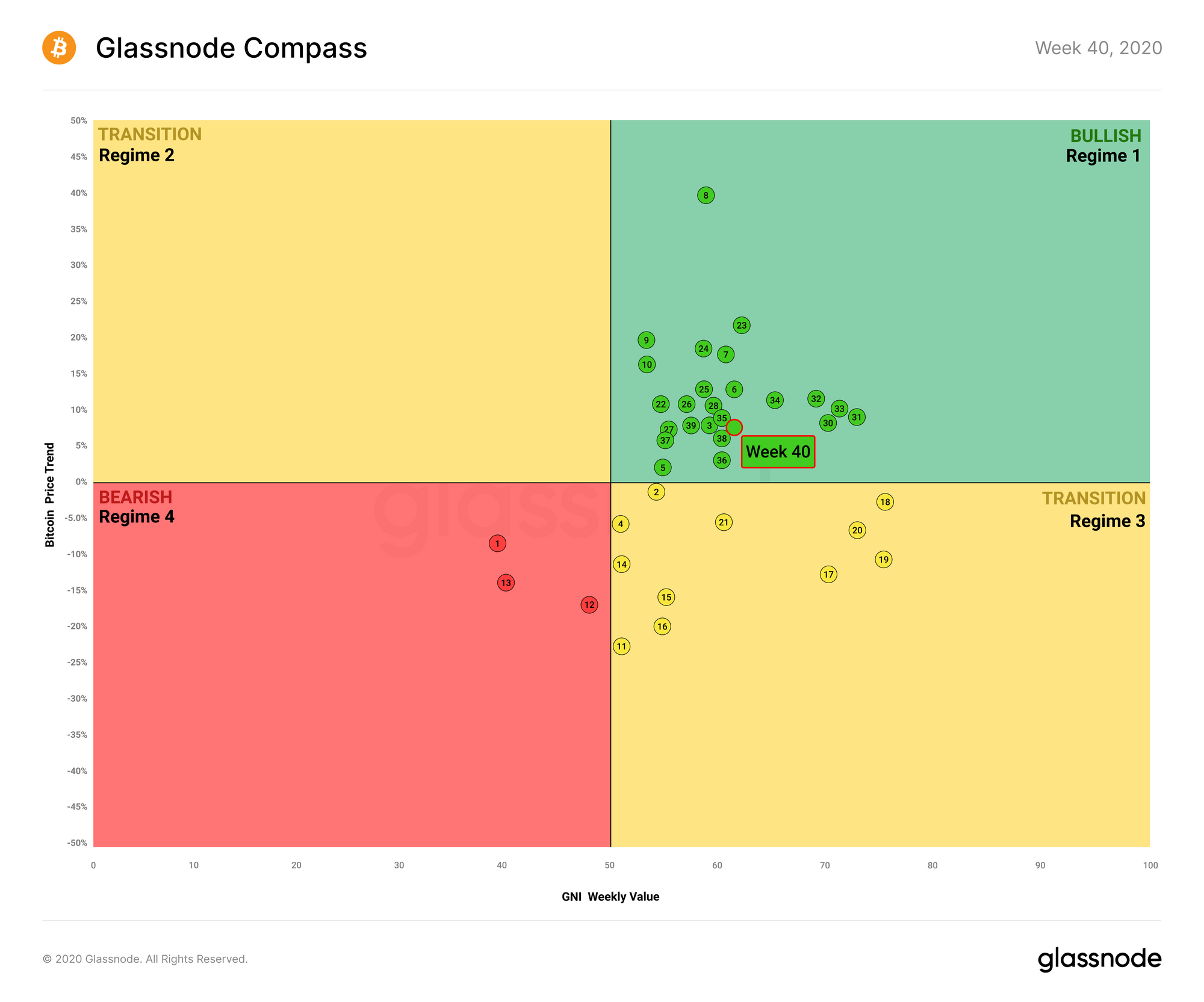

Now for the 19th week in a row, the bitcoin compass remains in Regime 1 - the bullish green zone. It has now been in this position continuously for almost half of the year so far.

This high compass score shows that bitcoin's fundamentals remain strong, and on-chain activity is healthy. A BTC price above $10k has found consistent support within the market, with the asset quickly recovering from its only recent drop below this point on 8 September 2020.

Meanwhile, the price of BTC is still closely tracking the stock market, with Thursday's price drop coinciding with a drop in stock market futures. Last week, we covered the reasons behind this correlation, and the driving forces necessary to initiate a decoupling. For the time being, however, BTC's price (and therefore the price of other cryptoassets) seems tied to the rest of the world's financial markets.

Investors should remain cognizant that, with the recent news of Trump's Covid-19 diagnosis and the uncertainty this brings, the near-term outlook for stocks is unclear. As such, short-term traders should keep a close eye on how this situation evolves in order to capitalize on volatility. Meanwhile, long-term hodlers can remain confident in the strength of bitcoin's underlying fundamentals, while simultaneously looking out for good buying opportunities in the coming days and weeks.

Altcoin Digest

Performance against BTC

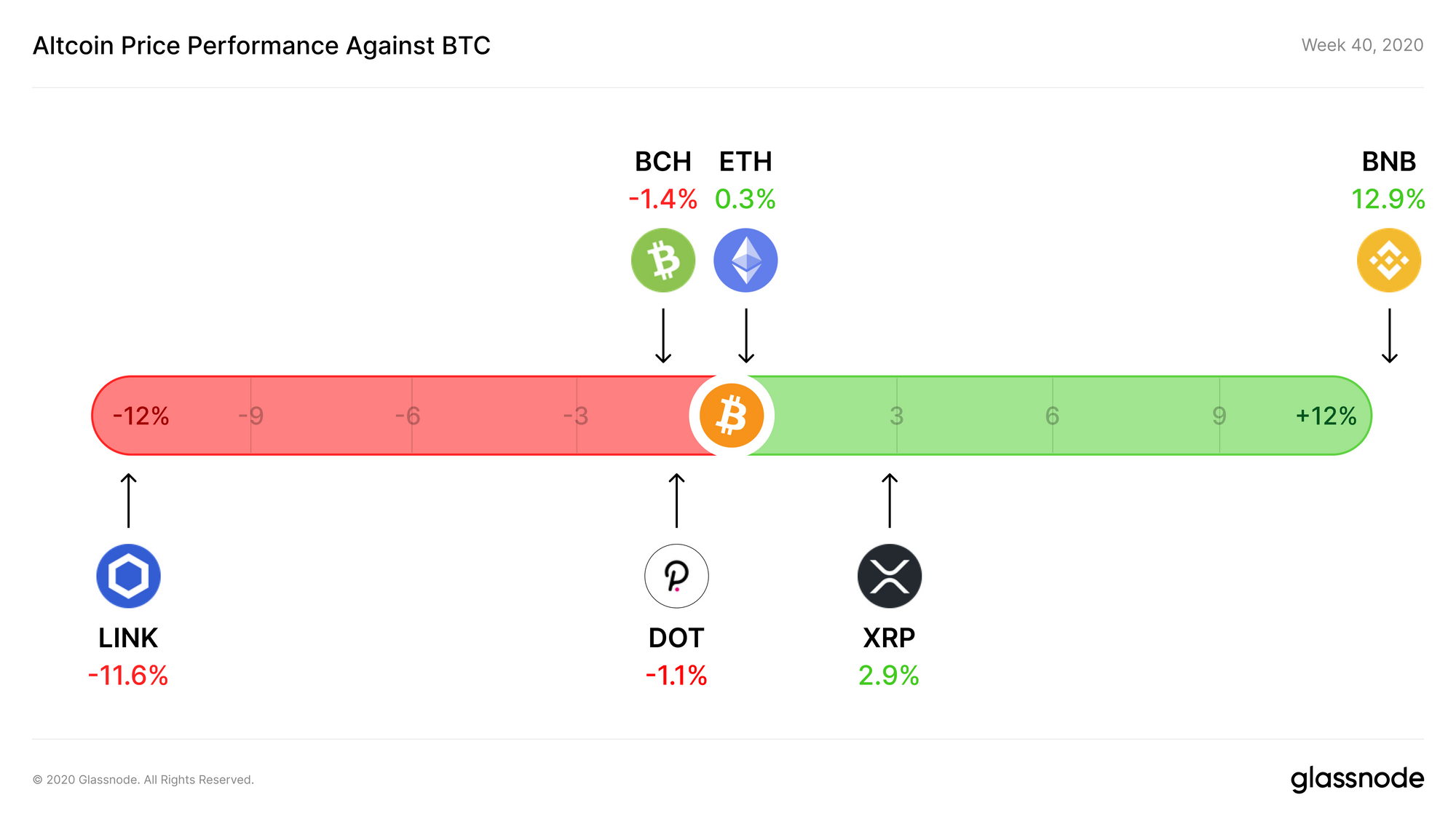

The top altcoins saw mixed performance against BTC over the past week. ETH, XRP, and BNB all gained value against the top cryptoasset, while DOT, BCH, and LINK all slipped in value.

BNB was the biggest winner of the week, gaining 12.9% against bitcoin and retaining its spot at the 5th most valuable cryptoasset, with a market cap of over $4.1 billion.

Performance against USD

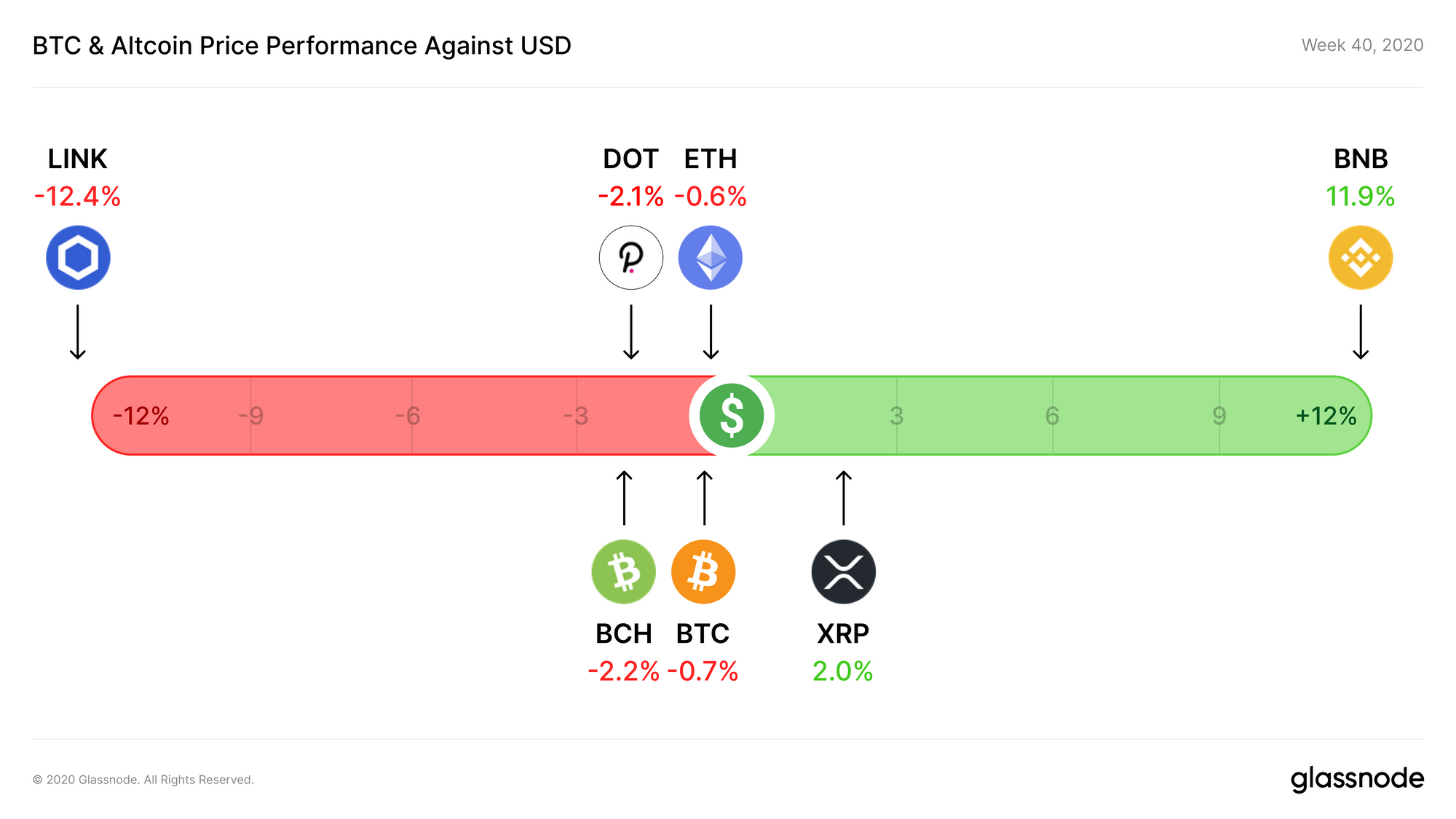

Throughout the week, BTC barely moved against USD, dropping in price by only 0.7%. Major protocol tokens like ETH, BCH, and DOT all stayed relatively stable, while the top utility tokens saw larger movements.

Continuing on its volatile path, LINK dropped by 12.4% over the week, after gaining 9.6% the previous week. Since falling from its all-time high of $19.85, its price has continued to fluctuate between $8 and $10.50 over the past month.

Which altcoins would you like to see us cover in future editions of The Week On-Chain? Let us know on Twitter.

Funds Flow from BitMEX Following CFTC Charges

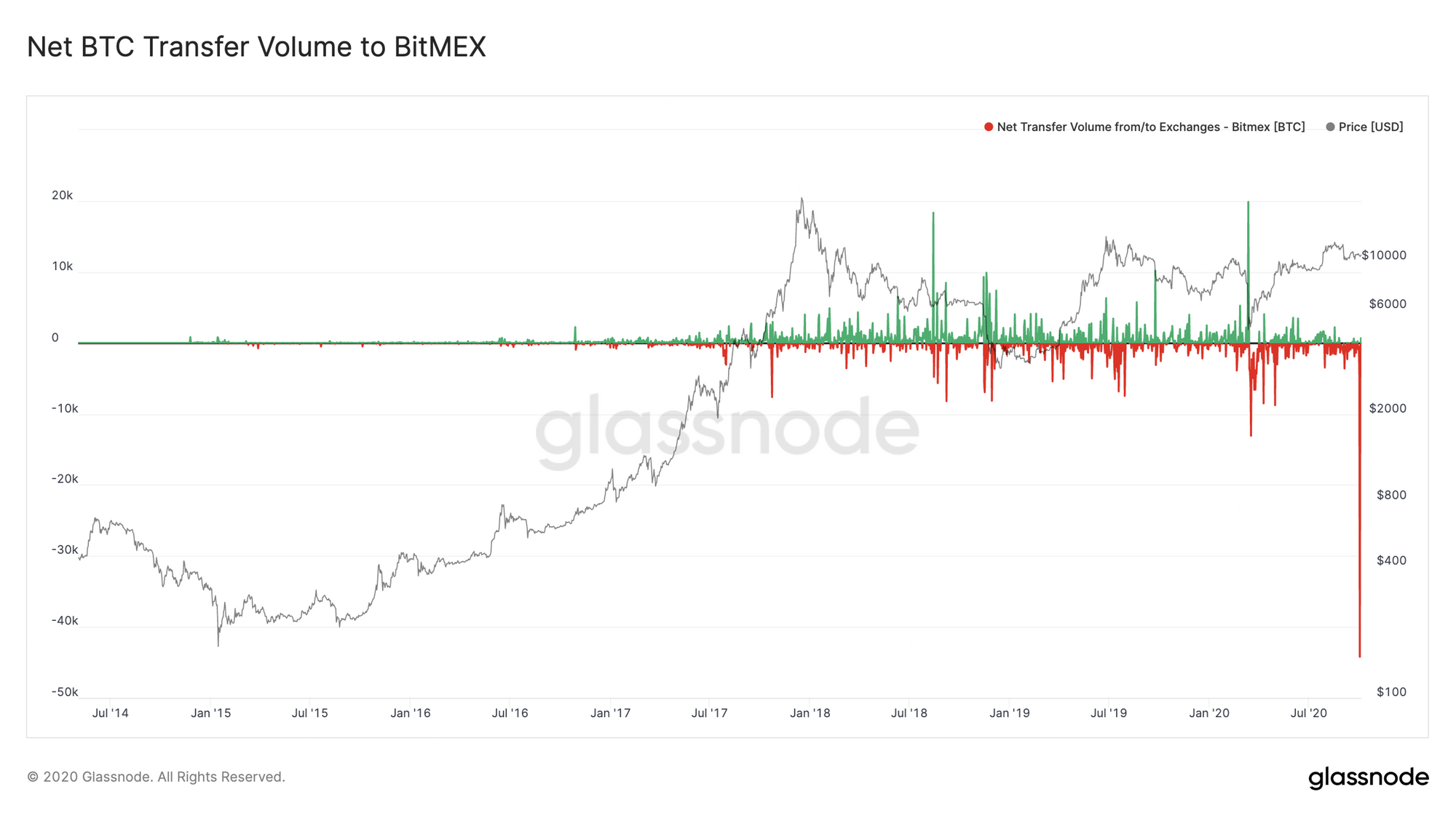

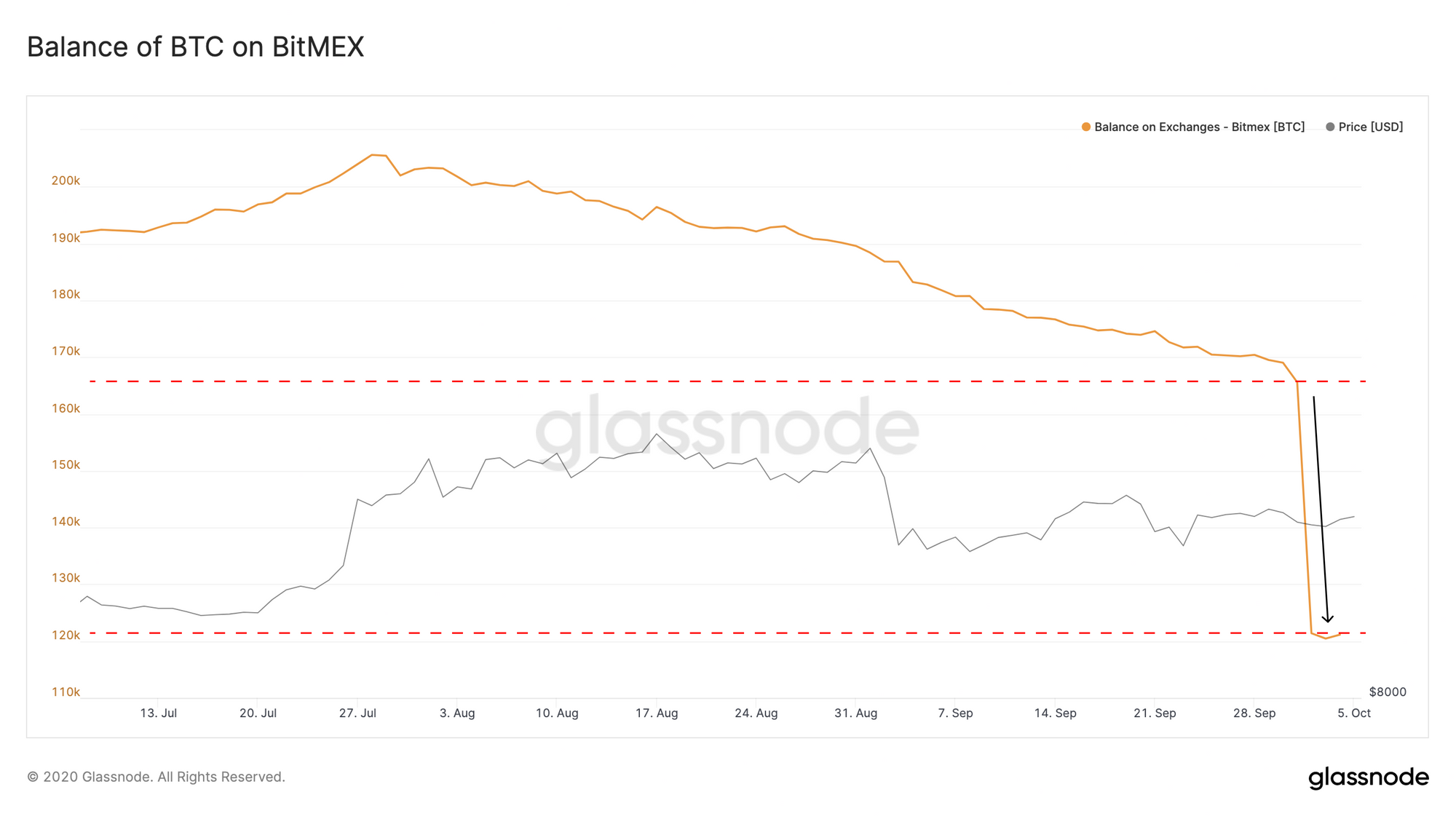

Last week, on Thursday 1 October, the popular exchange BitMEX, and a number of associated individuals, were charged by the CFTC for attempting to evade US regulations while operating an unregistered trading platform.

On Friday 2 October, the day after the announcement, BitMEX saw its largest ever day of net outflows as investors rushed to remove their funds from the now-risky platform.

Overall, since the announcement, almost 45,000 BTC have been withdrawn from the exchange, representing a 27% drop in the total balance of BTC on BitMEX.

At the same time, BTC open interest in perpetual futures contracts on BitMEX saw a significant decline as well, decreasing by almost 24% from $590M to $450M – levels not seen since May 2020. However, the market appears to be mostly unfazed, and bitcoin futures remain popular on other exchanges despite this setback.

Product Updates

Metrics and Assets

- Mean Transfer Volume To/From Exchanges (BTC, ETH, ERC-20) - New metrics showing the mean exchange inflow and outflow of a given asset.

- Follow us and reach out on Twitter

- Join our Telegram channel

- For on–chain metrics and activity graphs, visit Glassnode Studio

- For automated alerts on core on–chain metrics and activity on exchanges, visit our Glassnode Alerts Twitter